When it comes time to buy real estate, the entire process can seem a bit overwhelming. But buying a home…

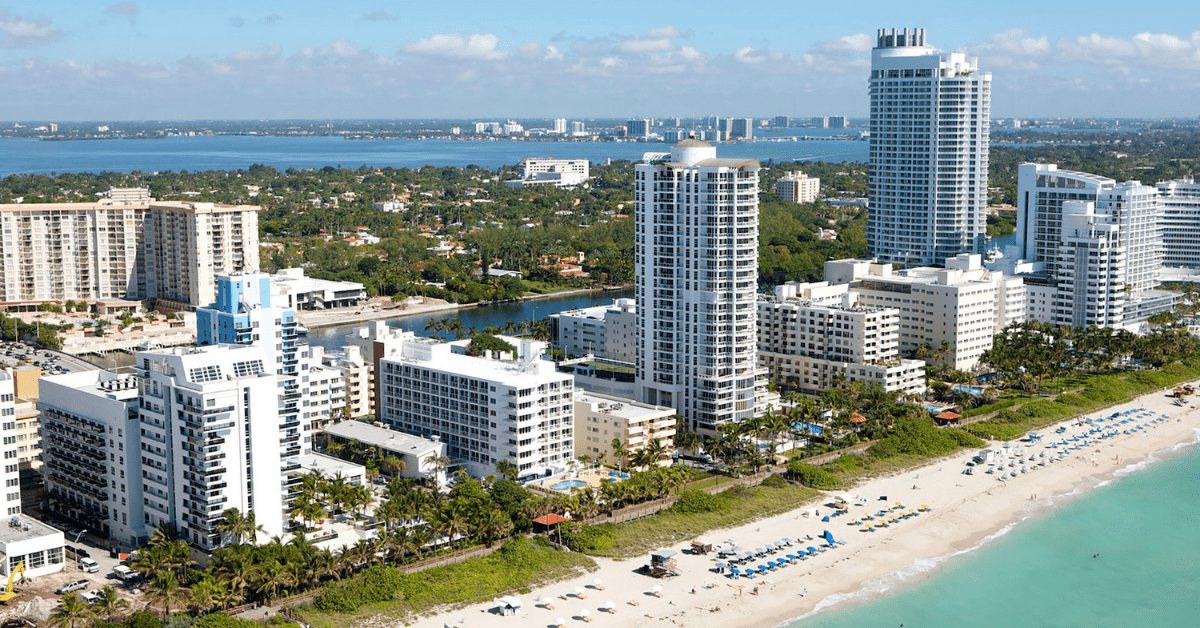

5 Tips for Purchasing Waterfront Property in Florida

Purchasing a waterfront home can be one of the biggest investments you’ll ever make. Not only are you purchasing a piece of real estate, but you’re also buying a lifestyle. You’ll be able to enjoy your place and relax in style knowing you chose the perfect place to call home. What do you need to know if you’re planning on purchasing waterfront property for yourself? Here are five tips for buying a waterfront home.

1. Figure Out Financing

Before shopping for a waterfront property for sale, you’ll need to figure out the financing first. Getting a mortgage pre-approval is critical because sellers are often advised by realtors to only accept offers from individuals who acquired a pre-approval. The available loans for waterfront properties typically fall under the category of jumbo mortgages, which is why you need to apply early and comprehensively. The market for these types of homes is also highly competitive so having your financing in place can help you immensely when there are multiple offers. You will want to make sure you can get your financing secured before looking at any properties for sale.

2. Use a Knowledgeable Real Estate Agent

You’ll want to look for a real estate agent who is specifically experienced in finding and selling waterfront homes, and Southern Florida is rich in beautiful waterfront properties. Florida is expected to exceed 22 million people in 2020 and surpass 26 million in 2030. Because of the popularity, you’ll want to use a licensed real estate agent like Henri Vezie who is highly knowledgeable about luxury waterfront properties. These properties have unique challenges that come with them. You’ll want someone on your side who can spot these issues and help you navigate through the process.

3. Determine Association Fees and Rules

Since many waterfront properties are a part of associations, there are certain rules you’ll have to follow as well as fees to pay. Ask your real estate agent what fees the association charges and why. You’ll also want to know about any regulations because they will impact what you’re able to do with the property. You may plan to build a large dock after you purchase your home, only to find that the association won’t allow it. Talk to your real estate agent about whether or not you’d be interested in an association.

4. Consider Various Insurance Policies

There are a number of different insurance types to consider when living in southern Florida. Homeowners are recommended to purchase a general hazard policy, a flood policy, and a wind policy. You’ll have to decide whether you want to purchase these three policies through one company or buy them separately. Obtaining flood insurance may or may not be required, depending on where the property is located. Certain waterfront homes are more prone to flooding than others. Each home you consider will have different requirements for insurance, so take your insurance research seriously.

5. Schedule an Inspection

Before you agree to buy any property, it’s important (and sometimes necessary) to have an inspection. An inspector can make sure there are no issues with water intrusion and determine if the property is hooked up to the public sewer system. Many waterfront properties are generally not hooked up this way. A faulty septic system can cost thousands of dollars for replacement or repair, so it’s a wise idea to have it thoroughly inspected.

Buying a waterfront property can take time and dedication; your hard work will pay off in the long run if you do it right. Even with all of these tips, the most important place to start is with the right real estate agent. Choosing the right professional will help make the process a whole lot easier. Give Henri Vezie a call today to help you find the best waterfront property for your needs.